Ever since I first started practicing law in New York 37 years ago, I’ve read lots of legal and financial documents. In fact, I’ve enjoyed the process of discovery and building a case as much as working with and representing my clients. Discovery takes time, patience, and a critical frame of mind, and I hope to apply that mindset to county budgets and legislation as your representative to the County Board of Legislators. I’m running because I want to make sure that District 10 has a representative who will parse before they pass.

Sitting down with the CAFR.

In preparation for the job, I’ve spent a good part of the last few days going through all 260 pages of the 2016 Westchester County Comprehensive Annual Financial Report (CAFR) with a fine-toothed comb. I’ve read it while sitting down at the kitchen table with a bowl of cereal, I’ve read it on the train to and from my office in downtown Manhattan, and I’ve read it while reclining on the couch after a long afternoon of canvassing. If you pay taxes in Westchester County, I encourage you to give it a read, too. County Executive Astorino’s biggest point of pride is his “balanced budget,” and by looking through the CAFR you may just find some of the budget shenanigans we’ve been hearing about over the past few years, hidden in plain sight. Here are some examples that I found:

- Filling budget gaps with real estate and privatization deals is not sustainable. In the 2016 summary of the County’s primary operating fund, we see traces of last year’s one-shot real estate sale in Yonkers that was used to cover current expenses.1 The $19 million sale was the sole reason the budget was balanced, otherwise we would have been $17 million in the hole. This year, County Executive Astorino’s big multi-million dollar deal is the the airport privatization scheme. After strong protests and recent statements from legislators, the airport deal seems well short of the 2/3rds vote of the Legislature to OK it. Where will the $15M come to replace it? Taking it from the fund balance (our “rainy day fund”) would reduce that balance from about 11% of the tax levy down to 8%—a big negative for bond rating companies. Perhaps our County Executive would like to “unlock” assets for last minute budget balancing until there is nothing left to sell off anymore?

- The “improved revenue” at the airport is misleading. “Improved revenue”2 sounds great, but improvement is relative. In the year prior, the County forfeited $7 Million of passenger facility charges because the County Planning Department has been cut so deeply that they were no longer able to do their jobs properly. We shot ourselves in the foot, and then bragged about being able to run faster without that pesky bullet lodged in our metatarsal.

- The county has been borrowing to pay current expenses.

Borrowing to pay for pension contributions.

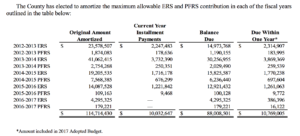

The County has “amortized”—a weaselly word for “borrowed and bonded over 10 years”—an average of $23 million per year of annual pension contributions owed over the last 5 years.3 This is a major expense—to put it in context, the County Exec’s famously “frozen” county property tax levy is $548 million—and would have required a big tax increase in an honest budget. Instead, that expense was passed on to our children and grandchildren, with interest.

- The contracts with County employees have long since expired,4 and they are owed years of back pay. The contract with CSEA 9200, the union with the most County employees, expired in 2011. Even before then, salary increases were essentially non-existent in the years following the 2008 national financial crisis. The County Executive’s office has stalled as long as they could by offering up unacceptable contracts. But eventually, either by negotiation or by the binding arbitration required by law on public employees’ contracts, they will have to come to the table. There will certainly be significant increases and retroactive pay in the millions of dollars, but no dollar amount at all seems to be reserved for this in the CAFR.

- The sales tax projections were way off.

The County Exec’s “balanced budget.”

From 2015 to 2016, sales tax revenues increased about 1.4% to $507.4 Million.5 But the “balanced budget” projected an increase of 5%, never mind that no mature economy is growing at that rate. On top of that, folks are buying more and more online where sales tax is not being captured. Fast forward a few months, and it turns out that actual sales tax receipts were about $20 million short, a huge shortfall. Another hefty increase in sales taxes was projected again for 2017, but the latest year-vs-year reports show an actual decrease in sales tax collections. If there’s one article you should read that shows how the wheels are already coming off, it’s this Journal News article on the projected budget deficit by Mark Lungariello.

The takeaway: when the County Executive and the Republican County legislators point their “balanced budget,” it really is too good to be true. There are millions upon millions of dollars of smoke and mirrors accounting in this report, another great example of the County Executive sweeping problems under the rug for the sake of political expediency. I’m running because I think all of this is unacceptable, and I plan on doing everything I can to be sure this won’t continue under my watch. I plan to take the long term view and be honest about our options. I know how tough it can be to keep an eye on budgetary tomfoolery when you’re leading a busy life, so as a legislator, I will read the budget, do the math, keep asking questions, and keep an open and honest dialogue with the constituents of District 10.

Citations from 2016 CAFR:

- Pg. 27

- Pg. 27

- Pg. 79

- Pg. 102 and 256

- Pg. 188-189

Well done, Damon. The first requirement of a public official should be honesty. These budgets are anything but.

Great work Damon. Thanks for doing the math.

This is so informative–thanks for taking the time to write and share what is happening in our government!

The best write up on the budget I’ve seen! A reason to support Damon Maher!

well done damon!

well done, damon…

watching this debate… garrity kept talking about you voting for tax increases, without going into any details… (just sweeping accusations).

http://newrochelle.granicus.com/MediaPlayer.php?publish_id=de5518ea-f46c-11e9-9542-0050569183fa

had to come back here to refresh my mem, to remember the great job you’re doing.

Thank you, Darnell.